TLDR¶

• Core Points: Amazon’s US CPU sales dropped ~60% YoY in January 2026, totaling ~26,100 units; AMD X3D remains dominant with 88% market share, signaling supply constraints in AI data centers rather than purely competitive losses.

• Main Content: Despite AMD X3D’s dominance, the broader PC and data-center CPU market is constrained by supply, especially for AI-focused deployments, impacting refresh cycles.

• Key Insights: Demand for AI-capable CPUs is high, but supply constraints are capping growth; Amazon’s numbers reflect an industry-wide slowdown in consumer and enterprise PC refreshes.

• Considerations: Supply-chain bottlenecks, enterprise AI deployment timelines, and shifting demand between consumer PCs and data-center infrastructure.

• Recommended Actions: Stakeholders should plan for continued capacity constraints, diversify supplier risk, and align procurement with AI data-center buildouts and usage patterns.

Content Overview¶

The January 2026 data point indicating a sharp year-over-year decline in CPU shipments by Amazon in the United States has drawn attention to the health of the PC refresh cycle. Figures compiled by TechEpiphany place Amazon’s US CPU sales at roughly 26,100 units for January 2026. While AMD’s X3D-based processors continue to capture a significant portion of the market—reportedly driving AMD’s share to an impressive 88 percent in relevant segments—the broader narrative appears more nuanced than a simple anti-competitive story of a single vendor’s triumph.

The standout statistic is not only the share of AMD’s X3D lineup but the persistent pressure on suppliers amid surging demand for AI-capable infrastructure. The data suggests that the PC refresh cycle—the process by which consumers and enterprises upgrade processors—has slowed, potentially due to sustained supply constraints, longer replacement cycles, or a shift in demand toward higher-end, data-center-oriented CPUs and accelerators. In other words, the competitive dynamics may be overshadowed by the reality that supply is not keeping pace with demand in AI data centers, while consumer PC purchases remain tempered by a cautious spending environment and the lingering impact of macroeconomic uncertainties.

This context helps explain why Amazon’s January numbers show a pronounced dip despite AMD’s reported market dominance in X3D-enabled platforms. If AI data-center deployments are growing but constrained by supply, the aggregate CPU market may appear stalled in the near term even as a segment of the market—particularly AI-ready, high-performance CPUs—remains in high demand.

In-Depth Analysis¶

The January 2026 CPU shipment figures for the US market, as tallied by TechEpiphany, mark a notable deviation from the growth trajectory that had characterized certain segments of the CPU market in prior years. Amazon’s reported sales of approximately 26,100 CPUs in the United States for that month represent a 60% year-over-year decline. Interpreting this data requires a careful differentiation between demand weakness and supply-side constraints, particularly in the context of AI data centers and high-performance computing.

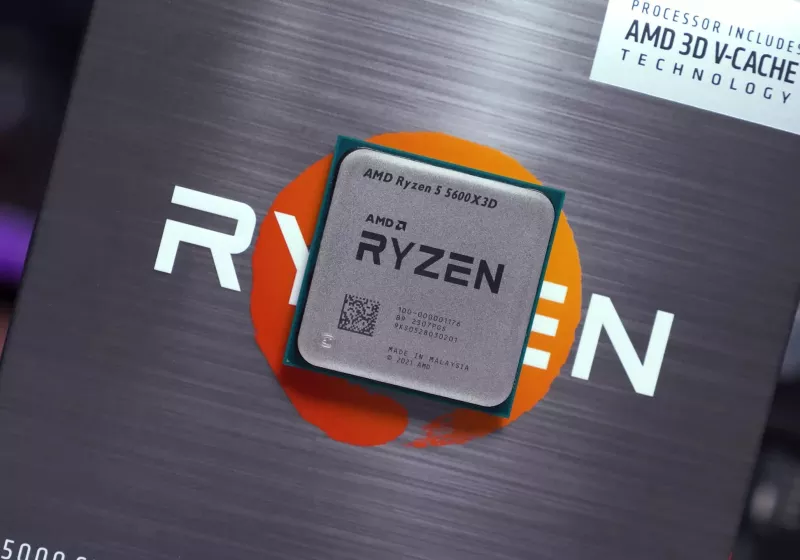

AMD’s X3D lineup, which leverages 3D vertical stacking of cache alongside architectural enhancements to improve gaming, workstation, and data-center workloads, continues to be a dominant force in the CPU space. The claim that AMD’s market share in relevant segments has reached 88% underscores the effectiveness of AMD’s recent product strategy, including the popularity of its 3D V-Cache technology for workloads that benefit from large, fast caches. This dominance, however, does not necessarily translate into uniform growth across the entire CPU market; it may instead reflect a reallocation of demand toward CPUs and accelerators that optimize AI workloads, where AMD’s architectural advantages are particularly pronounced.

A key takeaway is the shift in supply-demand dynamics within AI data-center ecosystems. AI workloads require not only raw compute power but also efficient access to memory bandwidth, low-latency interconnects, and specialized accelerators where applicable. In many cases, this has created a bottleneck where demand from hyperscalers and enterprise AI deployments outstrips available supply of CPUs and related infrastructure. The result can be a mismatch between the growth of AI-centric compute and the rate at which CPUs and related hardware can be produced and delivered.

Beyond AI data centers, consumer PC refresh cycles have shown signs of fatigue. Economic headwinds—such as inflationary pressures, interest rates, and broader macroeconomic uncertainty—can deter households and businesses from undertaking large-scale hardware refreshes. While AMD’s X3D success points to product-market fit in high-performance scenarios, the overall PC market may be cooling as replacement cycles lengthen and the lure of older, still-capable systems persists.

The broader market context also includes supply-chain constraints that have persisted across the technology sector in recent years. Semiconductor manufacturing remains complex and capital-intensive, with capacity allocation often driven by the most immediate demand signals and by tier-one customers. When AI-related demand surges, it can reallocate manufacturing capacity toward CPUs and accelerators used in data centers, even as consumer and general enterprise PC demand weakens or remains stagnant.

It is also important to consider the methodology behind the reported figures. TechEpiphany’s data collection and analysis likely aggregate multiple channels, including direct Amazon shipments, third-party marketplaces, and related channels. The 26,100-unit figure is a snapshot for January 2026 and may not fully capture seasonality, backlog, channel fill, or longer-term trends in demand. Nevertheless, the magnitude of the decline is striking and suggests the need to closely monitor both supply-side constraints and demand dynamics in the ensuing months.

From a market strategy perspective, vendors and distributors may need to adjust expectations around short-term CPU replenishment and product mix. If AI-centric demand remains robust but supply constrained, there could be continued price pressure on scarce high-demand SKUs, while more commodity-oriented CPUs may see softer demand or greater substitution as buyers stretch their dollars across a broader mix of components. The 88% AMD X3D share figure signals that competition may be narrowing in certain segments, but it also raises questions about whether other vendors will be able to scale to meet AI-focused demand or whether the market will continue to bifurcate into AI-optimized products and more general-purpose CPUs.

*圖片來源:Unsplash*

Another aspect worth analyzing is the potential impact on cloud providers and enterprise IT budgeting. If AI workloads drive incremental CPU and accelerator purchases but lead times extend due to supply constraints, cloud providers may adjust procurement strategies, including longer-term contracts, strategic stockpiling, or investments in alternative architectures that can deliver AI performance without relying solely on CPU improvements. Enterprises planning for AI deployments may also re-evaluate timelines and budget allocations, prioritizing projects based on expected time-to-value and available compute capacity.

In summary, while AMD’s X3D lineup maintains a strong leadership position in terms of market share, the selling environment for CPUs in January 2026 appears to be constrained by supply-side factors, especially in AI data centers. The reduction in unit sales at Amazon is instructive but does not singularly define the market’s health. Rather, it reflects a sector experiencing demand that is potentially outstripping immediate supply, alongside ongoing macroeconomic considerations and evolving enterprise priorities around AI.

Perspectives and Impact¶

Industry Implications: A large portion of PC-related CPU demand is likely tied to AI and data-center workloads rather than consumer PCs alone. If supply cannot keep up with AI-driven demand, manufacturers and distributors will need to reprioritize production forecasts and inventory management. The high AMD X3D share indicates strength in product-market fit for high-performance and AI-related tasks, but it may also magnify concerns about supply limitations for non-X3D CPUs that still power many client and server workloads.

Supply Chain Dynamics: Global semiconductor supply has shown resilience but also vulnerability to disruption. The January 2026 figures underscore the importance of diversified supply chains, multiple fabrication partners, and potential inventory strategies to mitigate the risk of stockouts in critical CPU SKUs. Manufacturers may explore closer collaboration with foundries, more aggressive pre-supply commitments, and alternative packaging or regional assembly options to expedite delivery.

AI Adoption Trajectory: AI continues to drive demand for more capable compute nodes. Even as the market slows in some consumer segments, AI-related hardware buys may persist or grow, albeit within a constrained supply framework. This dichotomy highlights the need for vendors to differentiate products not only by raw performance but also by efficiency, memory bandwidth, and integration with accelerators and AI software ecosystems.

Market Outlook: If the supply constraints persist, the industry might experience a stepwise improvement in availability as new fabrication capacity comes online and as companies optimize their supplier ecosystems. However, the near-term impact could include continued volatility in pricing, longer lead times, and selective shortages, particularly for the latest-generation CPUs with AI-optimized features.

Policy and Investment Signals: Governments and industry consortia that support semiconductor supply chain resilience may influence investment flows and capacity expansion plans. Public disclosures about demand trends, production ramp timelines, and strategic stock policies could indirectly shape procurement and pricing dynamics.

Key Takeaways¶

Main Points:

– Amazon sold about 26,100 CPUs in the US in January 2026, a 60% YoY decline.

– AMD’s X3D lineup commanded an estimated 88% share in relevant segments, signaling strong product reception.

– The broader narrative points to supply constraints in AI data-center-focused CPUs, rather than pure competitive losses driving market share.

Areas of Concern:

– Ongoing supply-chain bottlenecks limiting AI-ready CPU availability.

– Potential delays in PC refresh cycles for consumers and enterprises due to macroeconomic and procurement frictions.

– Market fragmentation where AI-optimized CPUs outpace traditional offerings in demand, potentially skewing price and availability dynamics.

Summary and Recommendations¶

In January 2026, Amazon’s US CPU sales dropped sharply year over year, with TechEpiphany estimating around 26,100 units sold. The context suggests that the decline reflects broader supply constraints tied to burgeoning AI data-center demand rather than a straightforward shift away from AMD or a collapse in consumer PC purchases alone. AMD’s X3D lineup’s dominant 88% share underscores the market’s appetite for high-performance CPUs that deliver substantial cache and memory advantages, particularly for AI workloads. However, the data also hints at a bifurcated market where supply constraints, longer replacement cycles, and macroeconomic headwinds temper overall growth even as demand for AI-capable compute remains robust.

For stakeholders, the implications are clear: maintain flexibility in supply chains, diversify sourcing to mitigate potential stockouts, and align procurement strategies with AI deployment timelines and expected data-center capacity expansions. As AI initiatives scale, vendors and buyers should anticipate ongoing demand volatility and prepare for a multi-speed market where AI-focused CPUs and accelerators dominate specific segments while traditional consumer and enterprise PC refresh activity lags.

Future months will reveal whether the supply-side constraints ease as new fabrication capacity comes online and as product cycles settle. Until then, the market appears to be navigating a stalled PC refresh cycle in the face of AI-driven demand, with AMD’s X3D technology occupying a strong, if insufficient, position to drive market momentum without addressing supply limitations.

References¶

- Original: https://www.techspot.com/news/111328-amazon-sold-60-fewer-cpus-than-year-ago.html

- Additional references:

- AMD X3D architecture overview and market impact

- AI data-center demand trends and CPU supply implications

*圖片來源:Unsplash*