TLDR¶

• Core Points: DRAM scarcity and rising AI data-center demand are driving higher prices for memory and storage; GPU and SSD prices climb as supply tightens; some phone makers reduce forecasted shipments due to component constraints.

• Main Content: Global supply-chain constraints and persistent demand from AI workloads are tightening memory markets, lifting prices for DRAM, NAND-based SSDs, GPUs, and HDDs; downstream effects include device pricing and manufacturer outlook revisions.

• Key Insights: AI data centers are a primary driver of memory demand; persistent supply constraints complicate recovery; inflation and logistics issues amplify pricing pressure across memory-intensive components.

• Considerations: Buyers may see continued volatility in memory-related prices; businesses should plan for longer procurement cycles and potential component shortages.

• Recommended Actions: Monitor memory and storage pricing trends, secure long-lead-time orders where possible, and explore alternative configurations or amortized purchase strategies.

Content Overview¶

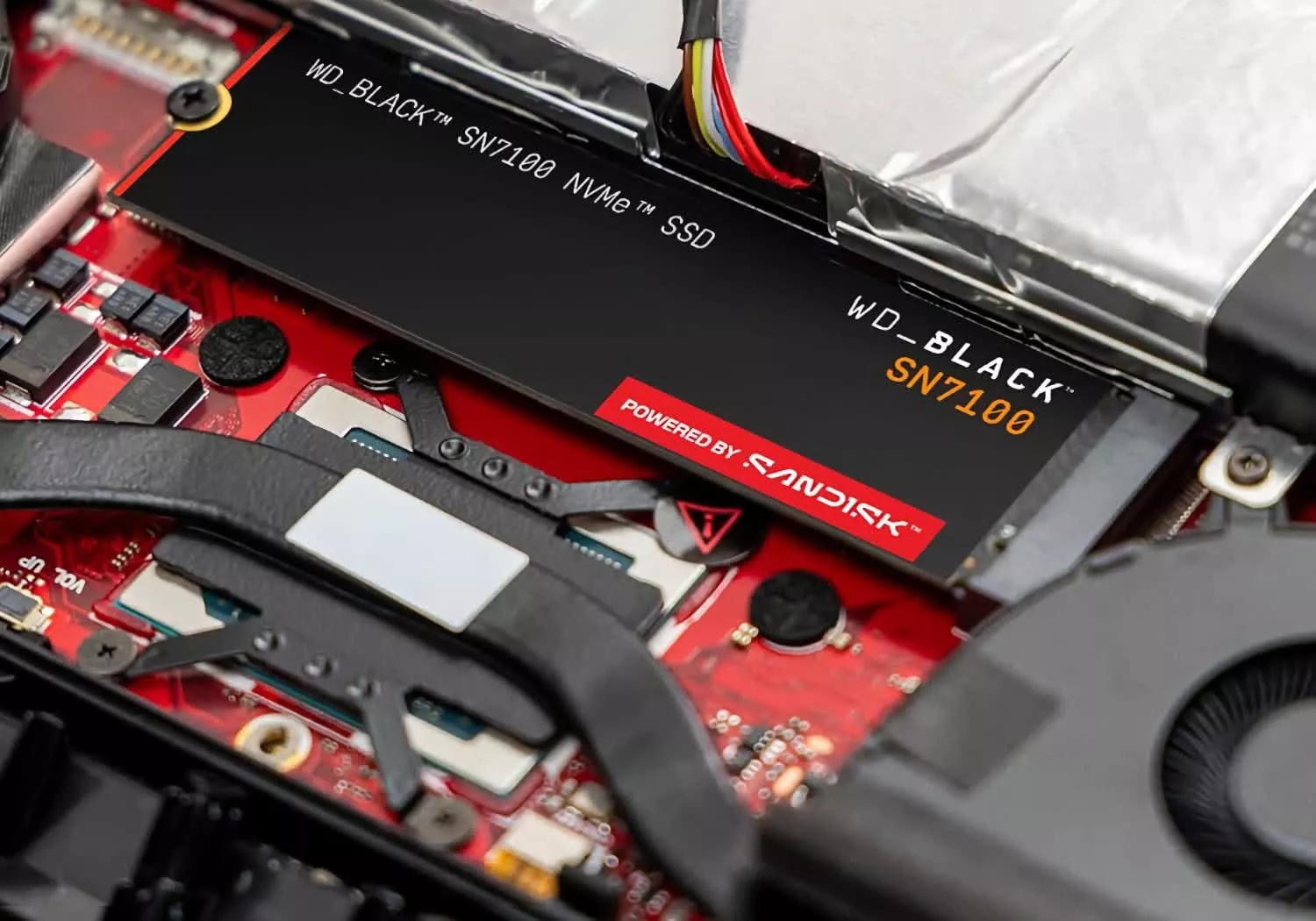

The global memory market has been contending with tight supplies and robust demand, a situation that has persisted into the current year. While DRAM shortages have already made upgrading memory more expensive for consumers and enterprises, recent weeks have seen a parallel rise in high-end solid-state drive (SSD) prices. This concurrent surge is not coincidental; it reflects the same market dynamics that have been driving the broader memory crunch: surging demand from AI data centers and ongoing constraints within the global supply chain. The combination of constrained supply and elevated demand for memory-intensive applications has created a ripple effect across the storage and graphics markets, elevating prices for SSDs, GPUs, and hard drives, and prompting some device makers to lower their sales projections as they reassess component availability and cost structures.

To understand the current pricing environment, it’s important to consider the different forces at play. First, AI workloads—ranging from training large language models to real-time inference—consume vast quantities of memory and high-bandwidth storage. Data centers deploying these AI solutions require substantial DRAM and NAND flash capacity, often prioritizing capacity, speed, and reliability over cost. As AI adoption accelerates, demand for memory components remains robust even as producers push new node advances and expand production capacity. Second, global supply chain constraints—such as limited fabrication capacity, equipment lead times, shipping interruptions, and geopolitical tensions—continue to bottleneck the flow of memory components from manufacturers to end users. These constraints limit the pace at which supply can catch up to demand, particularly for cutting-edge DRAM and high-performance SSDs used in enterprise and data-center contexts. Taken together, these factors have created a pricing environment where prices for memory-centric components—DRAM modules, PCIe NVMe SSDs, and related storage products—are elevated and prone to volatility.

The impact of these dynamics is felt across multiple segments of the hardware market. For consumers and enterprises looking to upgrade systems, the price tags on high-end SSDs have risen in tandem with DRAM costs. GPUs, which rely on memory bandwidth and capacity to deliver peak performance for gaming, professional workloads, and AI inference, have also seen price increases in response to the same supply-and-demand pressures. Traditional hard disk drives (HDDs) are not immune, as their costs can rise with competitive pressures and rising raw material costs, even as HDDs remain a more cost-effective option for bulk storage in data centers and consumer devices. Some phone manufacturers, contending with the wider component squeeze, have begun to adjust forecasts downward, signaling potential adjustments to product roadmaps and shipment volumes as they assess the broader impact of the memory shortage on mobile supply chains.

Beyond prices, the memory shortage has reshaped procurement strategies. Buyers—from enterprises planning data-center refreshes to consumers purchasing higher-end devices—are encountering longer lead times and less predictable availability. Vendors have responded by prioritizing higher-margin products, allocating scarce memory components to critical or strategic customers, and revising product mixes to align with current supply realities. The volatility also underscores the importance of strategic sourcing and risk management, including diversified supplier bases and longer-term contracts to stabilize pricing and supply.

In this environment, industry observers emphasize the need to differentiate between short-term price fluctuations and longer-term structural shifts. While supply constraints can ease as new fabrication lines come online and memory markets rebalance, sustained demand from AI workloads and ongoing geopolitical and logistical disruptions could maintain pricing pressure for the foreseeable future. Analysts caution that while some normalization may occur in the medium term, the memory and storage markets will likely experience continued volatility as supply chains adapt to evolving demand patterns and capacity expansions.

As the memory market evolves, stakeholders should monitor several indicators: new capacity additions and ramp-ups from DRAM and NAND producers, macroscopic demand trends in AI data centers, shifts in inventory levels across distribution channels, and pricing trajectories for key memory and storage products. The intersection of AI-driven demand, supply chain constraints, and macroeconomic conditions will continue to shape prices and availability for SSDs, GPUs, HDDs, and related products in the months ahead.

In-Depth Analysis¶

The memory landscape has entered a phase characterized by persistent tightness and heightened demand, a confluence that has meaningful implications for pricing and product availability across several core tech segments. To contextualize the current trajectory, it’s essential to separate the factors driving price increases from those that might soften prices in the near term.

1) Demand dynamics: AI and data-center proliferation

AI workloads—particularly training and inference tasks—are among the most memory-intensive applications in modern computing. Data centers that host AI models require large-scale DRAM for fast access patterns and abundant NAND flash storage to handle datasets, model weights, and checkpointing. As organizations across industries accelerate their AI initiatives, demand for high-performance memory modules and storage solutions has intensified. In many cases, this demand has outpaced incremental supply additions, pushing up prices for DRAM modules, PCIe NVMe SSDs, and enterprise-class HDDs. The higher-margin, enterprise-focused memory and storage products have become even more attractive to manufacturers seeking to maximize utilization of their fabrication assets during periods of constrained supply.

2) Global supply chain constraints: manufacturing and logistics

The memory market’s capacity to respond to rising demand hinges on the ability of producers to scale up fabrication, wafer supply, and package-and-test throughput. Global constraints—ranging from raw material bottlenecks to equipment lead times and skilled workforce shortages—have limited the speed at which memory production can expand. Equally important are logistics challenges: shipping delays, port congestion, and geopolitical frictions can elongate lead times and complicate just-in-time inventory models that many companies rely on. Together, these factors slow the pace at which supply can catch up with demand, sustaining elevated price levels for both DRAM and NAND-based products, including SSDs.

3) Product mix and pricing strategies

In response to constrained supply, manufacturers and distributors have adjusted product mixes to prioritize more profitable segments. Enterprise-grade SSDs and GPUs with higher memory bandwidth and capacity tend to command premium pricing during tight markets. In some cases, manufacturers bundle memory components with other value-add features or warranties to maintain margins. For consumers, this translates into higher street prices for high-performance SSDs and GPUs, especially models configured with top-tier capacities or advanced features. At the same time, some mainstream memory products may experience comparatively smaller price movements, as producers attempt to balance supply across various tiers to minimize revenue risk.

4) Implications for mobile and consumer devices

Phone makers and consumer electronics brands are not insulated from memory market conditions. When critical components are in short supply or expensive, manufacturers must make tough choices—ranging from delaying product introductions to lowering shipment targets or curtailing premium feature sets. In situations where memory and storage components are integral to a device’s performance profile, rising costs and uncertain availability can prompt revisions to expected launch windows or shipment forecasts. The result can be a cautious approach to roadmap planning and pricing, with consumer devices reflecting broader market headwinds in the form of slower refresh cycles or adjusted price points.

5) How the market might evolve

A path toward normalization hinges on several interdependent factors. New fabrication capacity—whether through older lines being repurposed, new fabs coming online, or efficiency gains in memory production—could gradually ease supply constraints. Inventory digestion by memory suppliers and tighter demand from non-AI sectors could also contribute to price stabilization. However, if AI demand remains robust and supply chain challenges persist, pricing discipline and strategic channel management will continue to shape the landscape. The issue is not solely about price levels; it also concerns availability windows, lead times, and the reliability of supply for memory-centric technologies that power both consumer devices and enterprise infrastructure.

6) Market signals and upcoming considerations

Industry watchers monitor several indicators that can foreshadow shifts in pricing and availability:

– Production capacity: announcements of new DRAM and NAND plants or upgrades and their expected ramp dates.

– Capex cycles: capital expenditure plans by memory manufacturers, which can indicate how aggressively they intend to expand capacity.

– Demand signals: AI project pipelines, enterprise budgeting for memory-intensive workloads, and consumer demand for high-performance SSDs and GPUs.

– Inventory dynamics: changes in channel inventory levels, OEM buffer stocks, and end-user purchasing behavior in response to price changes.

– Macro factors: currency fluctuations, inflation, and global shipping cost trends that can influence component pricing and availability.

*圖片來源:Unsplash*

The interplay of these factors will determine whether memory prices retreat in the near term or remain elevated for an extended period. While periodic corrections are likely as markets adjust, the structural drivers—AI-driven demand and persistent supply constraints—suggest that memory-related pricing may stay elevated relative to historical norms for some time.

Perspectives and Impact¶

The memory shortage’s impact extends beyond the price tags seen on SSDs, GPUs, and HDDs. It influences procurement strategies, device pricing, and the broader technology ecosystem’s investment decisions.

1) Enterprises and data centers

For enterprises planning infrastructure refreshes or deploying AI workloads, price volatility and lead times complicate budgeting and project timelines. IT teams may need to secure longer-term procurement commitments, diversify suppliers, and consider alternative configurations that balance performance with price. Data center operators might prioritize capacity planning that accounts for memory upgrade cycles, ensuring that memory expansion aligns with anticipated AI workloads. This can lead to more conservative growth trajectories in 2024 and beyond, even as demand remains strong for AI-enabled capabilities.

2) Consumer markets and device pricing

Consumer devices, including laptops, desktops, and premium smartphones, can see ripple effects from memory pricing dynamics. While flagship devices often absorb some cost pressures through refined supply-chain strategies and feature prioritization, mid-range and budget segments might face tighter margins or price adjustments. The broader consumer electronics market could experience slower refresh cycles, as brands weigh the trade-offs between performance improvements and component costs. End users may face longer wait times for certain configurations or higher baseline prices for devices that rely on high-capacity SSDs or advanced memory features.

3) Manufacturers’ outlooks and financial guidance

Companies in memory supply chains respond to evolving market conditions with updated guidance for investors and partners. When they anticipate sustained tightness, they may lower or adjust shipment targets, recalibrate product mix expectations, or announce price adjustments. This can translate into cautious financial outlooks and more conservative capital allocation plans in the short term. Conversely, signs of easing supply could reinvigorate growth plans, with producers signaling capacity expansions and more aggressive pricing strategies to regain market share.

4) Long-term implications for AI-enabled technology

The memory crunch underscores the critical role of memory and storage in enabling AI-enabled technology. As AI adoption grows across industries, the demand side could outpace the supply of memory components for the foreseeable future. This situation highlights the importance of ongoing innovation in memory technologies, alternative architectures, and efficiency improvements that reduce memory requirements per unit of AI throughput. It also emphasizes the need for resilience in supply chains—ensuring that component sourcing for memory-intensive devices remains robust in the face of geopolitical and logistical challenges.

5) Potential policy and market considerations

Policy makers and market regulators could monitor supply-chain vulnerabilities in memory markets, particularly given the strategic importance of AI, cloud services, and data infrastructure. Initiatives that encourage diversification of supply sources, investment in domestic manufacturing capacity, and transparency in pricing could influence how the market adapts to sustained demand and supply pressures. At the same time, industry associations may facilitate collaboration on standards and best practices for memory chips and storage technologies, supporting more efficient production and distribution networks.

Key Takeaways¶

Main Points:

– AI data centers are a primary driver of elevated memory demand, pressuring DRAM and NAND supply.

– Global supply chain constraints contribute to higher prices and longer lead times for memory-centric components.

– The memory shortage affects SSDs, GPUs, HDDs, and even mobile device projections, shaping pricing and roadmap decisions.

Areas of Concern:

– Prolonged price volatility and potential delays in device launches or upgrades.

– Tight supply could constrain enterprise AI deployment timelines and data-center expansions.

– Consumers may face higher costs or longer wait times for high-end storage and memory-equipped products.

Summary and Recommendations¶

The memory market remains tightly balanced between strong demand from AI workloads and ongoing supply-chain constraints. Prices for DRAM, SSDs, GPUs, and HDDs are elevated due to these paired pressures, with data centers and AI applications acting as critical drivers of demand. While there are expectations for gradual normalization, the pace will depend on capacity expansions, logistics improvements, and the broader macroeconomic environment. For buyers and businesses, proactive management of memory procurement is prudent. This includes locking in long-lead-time orders where feasible, diversifying supplier ecosystems to reduce concentration risk, and evaluating alternative configurations or storage architectures that can deliver the necessary performance at a potentially lower cost. As AI adoption continues to intensify, the memory market will remain a focal point for pricing, supply stability, and strategic investment.

References¶

- Original: https://www.techspot.com/news/110975-memory-shortage-driving-up-prices-ssds-gpus-hard.html

- Additional references:

- https://www.anandtech.com/show/17090/memory-market-outlook-2024/

- https://www.tomshardware.com/news/memory-shortage-ai-demand-ram-nand-prices-2024

*圖片來源:Unsplash*