TLDR¶

• Core Points: Amazon’s 30-minute delivery trial signals a shift toward ultra-fast, location-based grocery and everyday-use goods delivery, with implications for operations, logistics, and consumer expectations.

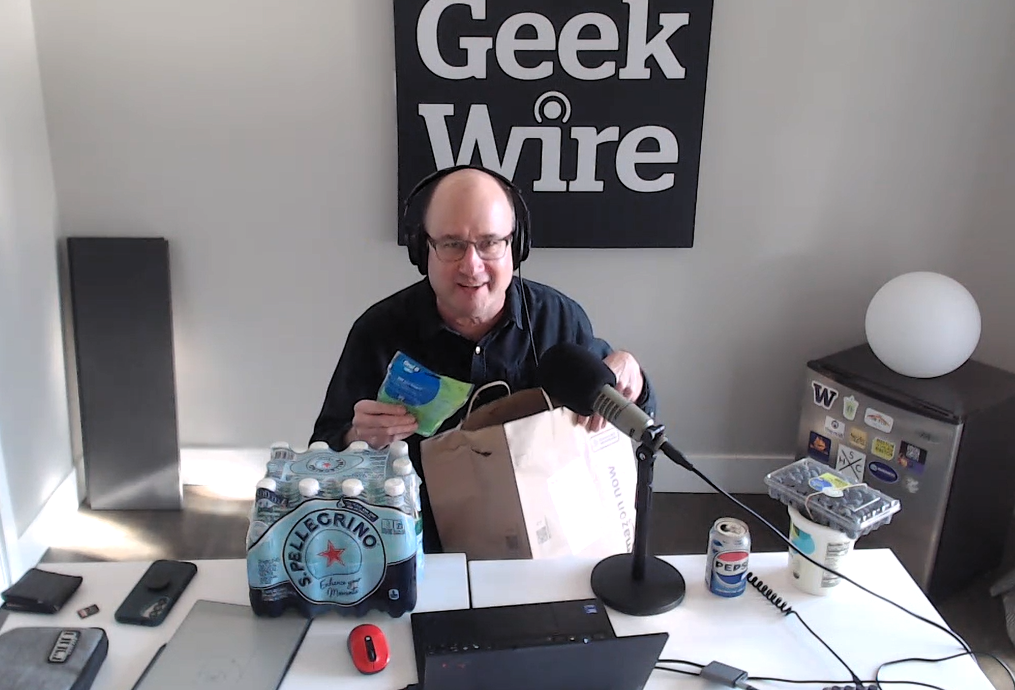

• Main Content: A live podcast discussion with Mike Levin and Josh Lowitz of Consumer Intelligence Research Partners analyzes what ultra-fast delivery means for retail, groceries, and Amazon’s next moves.

• Key Insights: Speed-driven delivery is reshaping fulfillment networks, inventory placement, and last-mile partnerships; efficiency gains hinge on data, risk management, and regional rollout strategies.

• Considerations: Privacy, worker conditions, cost structure, and potential impact on small retailers must be addressed as services scale.

• Recommended Actions: Retailers should assess local demand signals, invest in micro-fulfillment and delivery-capable staffing, and develop transparent communication about fees and service levels.

Content Overview¶

The concept of ultra-fast delivery—delivering groceries and everyday items within a tight time window—has evolved from a niche experiment to a strategic area of focus for major retailers and e-commerce platforms. In a recent podcast episode, analysts examined Amazon’s foray into 30-minute delivery, detailing how the service operates, what it entails for the grocery sector, and what it could signal about the broader trajectory of retail. Mike Levin and Josh Lowitz from Consumer Intelligence Research Partners provided their perspectives on the operational challenges, potential cost structures, and customer value propositions associated with this model, offering a balanced view of the opportunities and risks involved.

Ultra-fast delivery rests on a complex mix of automation, micro-fulfillment, delivery network optimization, and real-time inventory visibility. For Amazon, the approach likely leverages small-format fulfillment nodes placed near dense residential areas, backed by a fleet capable of rapid dispatch and efficient routing. The podcast explored whether a 30-minute window is sustainable at scale, how loss leaders or high-margin product segments might subsidize the service, and what consumer behavior data suggests about willingness to pay or tolerate service variability. The discussion also touched on the broader implications for grocery retailers, convenience stores, and online marketplaces, emphasizing that speed is only one element of a successful, profitable delivery proposition.

The episode underscored that while innovative, ultra-fast delivery must balance customer expectations with operational realities. Factors such as order accuracy, product substitutions, delivery appointment windows, and reliability become more critical when the promise is a 30-minute delivery promise. The analysts highlighted the importance of robust routing algorithms, real-time inventory management, and the ability to coordinate a large workforce and network of delivery drivers or carriers. They also noted that the success of such a model depends on careful market selection—starting in urban cores or highly dense suburbs before expanding outward—and on controlling costs through efficiency gains rather than allowing the cost of speed to erode margins.

Overall, the conversation situated Amazon’s experiment within a larger retail trend: the race to shorten time-to-doorstep as a differentiator, while simultaneously rethinking the economics of delivery, fulfillment, and customer loyalty. The insights offered a cautious but forward-looking perspective on how ultra-fast delivery could shape competition, partnerships, and the structure of future retail ecosystems.

In-Depth Analysis¶

Ultra-fast delivery, epitomized by a 30-minute window, represents more than a mere speed upgrade; it reflects a broader reorganization of how goods flow from the point of origin to the consumer’s doorstep. The podcast conversation with Levin and Lowitz delves into several core themes that deserve close examination for anyone tracking the evolution of grocery and retail logistics.

1) The operational blueprint behind ultra-fast delivery

The primary enabler of 30-minute delivery is a tightly integrated network of micro-fulfillment centers (MFCs), proximity inventory, and advanced delivery routing. MFCs—compact facilities often located within or near dense urban areas—house curated assortments of everyday essentials. They enable rapid picking and staging, which, when combined with sophisticated last-mile routing algorithms and real-time traffic data, can dramatically reduce travel time. The analysts emphasized that the success of this model hinges on maintaining high order accuracy and ensuring that the most frequently purchased items are readily available within each micro-fulfillment node. Any mismatch between advertised availability and actual stock can quickly erode consumer trust in a time-sensitive service.

2) Economic considerations and pricing dynamics

A recurring question in the discussion is whether the economics of ultra-fast delivery are viable on a broad scale. The podcast highlighted several levers that could tilt the cost-benefit equation in favor of retailers: operational efficiency gains from automation, labor productivity improvements, dynamic pricing, and the cross-subsidization of slower, higher-margin products. For instance, delivering high-frequency, low-margin grocery staples quickly could attract more customers, increasing lifetime value even if per-order margins are slim. Conversely, if the service is offered as a premium, paid option, retailers must clearly articulate the value proposition to justify the added cost for consumers. The analysts noted that effective marketing and transparent communication about delivery windows and fees will be crucial to sustaining demand while controlling churn.

3) Customer behavior and demand signals

Consumer appetite for speed is strong but not universal. The podcast underscored that fast delivery may be most compelling for time-constrained urban residents, busy families, and last-minute shoppers who need specific items quickly. In such cases, the value of saving time can outweigh price considerations. However, for routine purchases or for customers in less dense areas, slower delivery or pickup options may still prevail. Retailers should leverage data analytics to identify which products and geographies generate the highest propensity for 30-minute delivery, and adjust inventory placement and staffing accordingly. This targeted approach helps minimize wasted capacity and aligns the service with real demand.

4) Implications for the grocery ecosystem

The introduction of ultra-fast delivery by a major platform has ripple effects beyond the retailer’s own order pipeline. Competitors—ranging from traditional supermarkets to online marketplaces—must decide whether to adopt similar speed-focused models, partner with delivery networks, or double down on other differentiators such as product assortment, private-label offerings, or in-store experiences. The podcast discussion suggested that collaboration and competition will intensify as utilities like driver networks, route optimization technologies, and fulfillment capabilities become more accessible. In some cases, retailers might pursue hybrid models that combine in-store picking with dark-store micro-fulfillment hubs to optimize costs and coverage.

5) Labor, safety, and regulatory considerations

With rapid delivery comes heightened scrutiny of worker conditions, compensation, and safety protocols. The demand for faster service increases turnover risk and can intensify scheduling pressures on drivers. The discussion acknowledged these dimensions as non-trivial risks that could affect long-term viability if not properly managed. Regulatory environments around gig workers, minimum pay standards, and workplace safety will interact with the scalability of ultra-fast delivery. Retailers and delivery platforms will need to adopt clear labor practices, fair compensation, and robust safety standards to maintain service reliability while safeguarding workers’ well-being.

6) Technological and data infrastructure

Data is the backbone of ultra-fast delivery. Real-time inventory visibility, demand forecasting, and dynamic routing rely on sophisticated software platforms, integrated ERP systems, and seamless data exchange between suppliers, fulfillment centers, and last-mile carriers. The podcast highlighted that investments in data quality, machine learning models, and predictive analytics are essential to improve fill rates, reduce stockouts, and minimize delivery delays. As the model expands, interoperability across partners and adaptability to regional differences will be critical to sustaining performance.

7) Long-term strategic implications

Looking ahead, ultra-fast delivery could redefine what customers expect from retail as a whole. If the model proves scalable and profitable, it could reshape store formats, with a possible shift toward smaller, neighborhood-oriented fulfillment nodes rather than large, centralized warehouses. Retailers might also explore new partnerships with tech platforms for routing, autonomous delivery, or curbside micro-fulfillment. The discussion emphasized that early experimentation is valuable, but broad adoption will require a careful balance of speed, cost, reliability, and customer experience.

*圖片來源:Unsplash*

In their analysis, Levin and Lowitz stressed that Amazon’s experimentation with 30-minute delivery should not be viewed in isolation. Rather, it is part of a broader strategic push toward speed-enabled convenience that could redefine how retailers allocate capital, plan real estate, and design inventory systems. The transition toward faster delivery is likely to be evolutionary rather than revolutionary, with incremental improvements layering over time as networks mature and technology matures.

Perspectives and Impact¶

The ultrafast delivery conversation carries implications for multiple stakeholders in the retail ecosystem, including consumers, retailers, logistics providers, and policymakers. Here are key perspectives and potential impacts to watch in the near and medium term.

1) For consumers

– Expectation setting: As speed improves, consumers will increasingly expect shorter delivery windows. This could lead to higher satisfaction when promises are met, and greater frustration when delays occur. Clear communication about available windows, fees, and substitutions will be critical to maintaining trust.

– Service prioritization: Ultra-fast delivery may become a preferred option for urgent needs, such as perishables or spontaneous purchases, while less time-sensitive items continue to be delivered via slower channels or pickup options. Retailers should provide flexible choices to accommodate varying customer priorities.

2) For retailers and grocers

– Network redesign: The push toward speed may necessitate new fulfillment footprints, including micro-fulfillment centers and strategically placed dark stores. This requires capital planning, site selection expertise, and a reorientation of supply chain processes.

– Margin management: The cost-to-serve for ultra-fast delivery will likely be higher than standard delivery. Retailers will need to identify profitable product mixes and possibly implement tiered pricing to balance consumer value with operational costs.

– Competitive differentiation: Speed could become a differentiator alongside price, quality, and assortment. Retailers that win in speed may reap benefits in customer loyalty and frequency of purchase.

3) For delivery platforms and logistics providers

– Technology-enabled value: Providers that can deliver reliable, fast, and accurate service stand to gain market share. Investments in routing optimization, demand forecasting, and driver capacity will be pivotal.

– Labor models: The scalability of ultra-fast delivery will depend on sustainable labor practices and compensation models that attract and retain a reliable workforce while complying with evolving regulations.

4) For policymakers and communities

– Labor standards and safety: Rapid delivery models must align with labor protections and safety guidelines. Policymakers will scrutinize working conditions, wage standards, and the health and safety of those performing last-mile tasks.

– Local impact: Increased delivery activity can affect traffic patterns, noise, and urban congestion. City planners may need to coordinate with retailers and delivery networks to manage impact and infrastructure needs.

5) For the broader retail industry

– Pace of innovation: The streaming of small-format fulfillment and rapid delivery could catalyze a broader rethinking of store formats, supply chain visibility, and cross-channel integration.

– Partnerships and ecosystem effects: Success in ultra-fast delivery may lead to more partnerships between retailers, technology platforms, and regional carriers, creating an ecosystem where speed is a shared capability rather than a single company’s advantage.

Overall, the perspectives surveyed in the podcast suggest that ultra-fast delivery is more than a novelty; it is a strategic bet on how fast, flexible, and highly responsive retail can become. The outcome will depend on how effectively retailers manage the tension between speed, cost, and customer experience, while navigating labor considerations, regulatory constraints, and competitive dynamics.

Key Takeaways¶

Main Points:

– Ultra-fast delivery (30-minute windows) is a strategic bet that requires a dense network of micro-fulfillment centers and sophisticated routing.

– Economic viability hinges on efficiency gains, pricing models, and targeted demand, rather than universal applicability.

– Consumer demand for speed varies by geography and need, necessitating data-driven rollouts and selective investment.

Areas of Concern:

– Labor practices and worker safety in a high-speed delivery environment.

– Potential erosion of margins if speed becomes the default expectation without cost controls.

– Privacy and data security considerations as fulfillment networks grow and data becomes more granular.

Summary and Recommendations¶

Ultra-fast delivery represents a notable evolution in retail logistics, signaling a future where speed is a primary differentiator for consumer-facing services. The approach leverages micro-fulfillment, real-time inventory management, and optimized last-mile routing to meet tight delivery promises. However, profitability depends on a nuanced blend of efficiency, selective market expansion, and thoughtful pricing strategies. Retailers should pursue a staged, data-informed rollout that concentrates on high-density markets first, building out micro-fulfillment nodes and delivery capacity in tandem with robust inventory governance. Equally important is investing in workforce practices and safety protocols to sustain long-term operations and maintain consumer trust. While the potential is significant, success will require balancing speed with cost discipline, reliability, and strong customer communication.

In the near term, expect further experimentation and partnerships as retailers test which product categories and geographies benefit most from ultra-fast delivery. Over time, the model could influence store formats, inventory placement, and cross-channel strategies, shaping the next phase of retail competitiveness.

References¶

- Original: https://www.geekwire.com/2026/we-tested-amazons-speedy-delivery-live-on-the-podcast-heres-what-it-says-about-the-future-of-retail/

- Additional references:

- Similar industry analysis on ultra-fast delivery and micro-fulfillment networks

- Retail logistics studies examining last-mile optimization and labor considerations

*圖片來源:Unsplash*